Paris, 12 September 2022 – Apax, a leading European private equity firm, announces that it has acquired, via its Apax Development fund, a majority stake in Mailinblack, a software company based in Marseille that makes cybersecurity solutions accessible to all organisations.

Apax’s acquisition of a majority stake, alongside the managers and historic shareholders (Entrepreneur Invest and the founder, Damien Neyret) and the NewAlpha Verto fund, will allow the company to accelerate its development of cutting-edge cyber security solutions.

Mailinblack currently offers two complementary products:

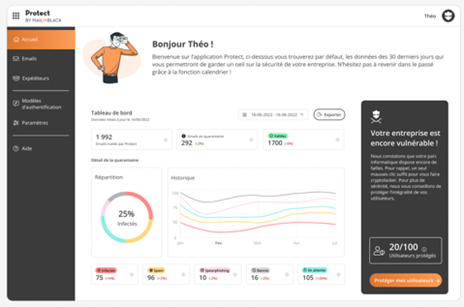

“Protect” is a security solution for business emails (anti-spam, phishing, malware), the main entry point for cyberattacks. Mailinblack processes more than 5 billion emails every year for 14,000 organisations.

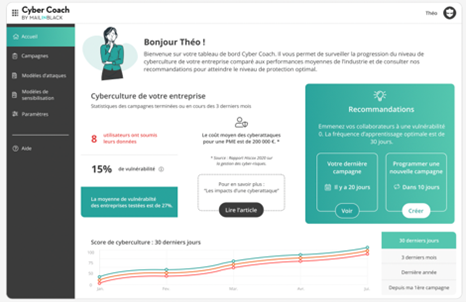

“Cyber Coach”, launched by Mailinblack in 2021, trains and educates employees on best practices in dealing with potential cyber attacks. Given that it is estimated that 90% of successful attacks are linked to human error, prevention is a key aspect of cyber defence. This solution is helping Mailinblack to settle a cyber culture into organisations and train employees to become the first line of defence against cyber attacks.

After reinventing our historic product, Protect, known by all and used by 14,000 customers, using Artificial Intelligence previously restricted to major customers, we redesigned employee cyber security training with Cyber Coach, an experiential learning solution that simulates email-based cyber attacks, which has already been adopted by more than 600 customers. We are now looking to consolidate our leading position in Europe by creating a suite of digital protection solutions for business users, aimed at CIOs. This financial transaction will allow us to diversify our product offering by developing and entering into partnerships and by acquiring products such as password management, document transfer and digital clean-up solutions

Thomas Kerjean, Mailinblack’s Chairman and Chief Executive Officer

Creating a leading European cyber security company in Europe with revenue in excess of €40m

Used to seeing double-digit growth, Mailinblack’s revenue grew 28% in 2021, while its customer base (principally SMEs, local authorities and healthcare institutions) increased by 15%.

With the support of Apax, Mailinblack is seeking to quadruple its revenue by 2026, by accelerating hires into its marketing team, growing its direct and indirect sales channels and developing complementary products.

In a fragmented market in which businesses are ripe for foreign takeovers, Mailinblack is contemplating acquisitions of software companies with an ARR (Annual Recurring Revenue) of between €1m and €10m, both in France and Europe.

Mailinblack has become the leading provider of email protection and cyber threat training solutions in the middle-market segment. With a loyal customer base, the company is ready to add new user protection solutions to its offering. We were impressed by the manager’s vision, the high quality of the management team and its ambition in terms of innovation. We are happy to support its growth in both France and Europe through the eighth investment by our fund, Apax Development

Bérenger Mistral, Partner at ApaxDevelopment.

Apax’s investment is being made by its Apax Development and Apax Private Equity Opportunities (APEO) funds– its dedicated life insurance and capitalisation contracts fund – and the Apax Philanthropy Fund (its philanthropic fund).

List of advisors

Apax Development: Bérenger Mistral, Thibaut Bourlet, Baudouin Delcampe, Arnaud Parry

NewAlpha Verto: Thomas Fort, Antoine Dary, Pierre Cuer

Buyer advisor

- M&A: Lincoln International (Matthieu Rosset, Boris Martin, Charles Plassart)

- Corporate legal team: Hogan Lovells (Stéphane Huten, Florian Brechon, Alexandre Giacobbi, Guillaume Denis, Ombeline Despres), Charles Russell Speechlys (Thibaut Caharel, Pierre-Adrien Mayot)

- Financing legal team: Hogan Lovells (Alexander Premont, Ouassila El Asri, Alban de Roucy)

- Tax legal team: Hogan Lovells (Ludovic Geneston, Thomas Claudel, Maryll Pizzetta)

- Financial due diligence: Exelmans (Stéphane Dahan, Manuel Manas, Océane Lambert, Philémon Defontaines)

- Commercial due diligence: Altman Solon (Frederic Huet, François-Nicolas Kielwasser, Arthur Bourguignon, Jules Guiton)

- IT due diligence: Make it Work (Frédéric Thomas)

- Legal due diligence: Mazars (Jérôme Gertler, Iosif Cozea, Camille de Kervenoael)

Vendor advisors

- M&A: Bryan Garnier (Thibaut De Smedt, Stanislas de Gmeline, Charlie Pujo, Maxime Roi, Xavier de Fontaines)

- Vendor legal advisors: BBLM (Fabien de Saint-Seine)

- Financial due diligence: KPMG (Philippe Blanadet, Victor Chemineau)

Financing

- Crédit Agricole Alpes Provence (Christophe Lejeune, Arnaud Duparc, Olivier Flonneau)

- Eurazeo IM (Emmanuelle Tanguy, Agathe Prevosteau)

- Financing legal advisors: Volt et Associés (François Jubin, Lina Bahri), Nabarro Béraud (Jonathan Nabarro, Magali Béraud, Emilie Darcq)

Mailinblack advisors

Scotto Partners (Jérôme Commerçon, Alexandre Zouhal, Caroline Vieren, Loïc Pipaud)