This is an advertising communication.

Please refer to the fund rules and key information document before

making any final investment decision.

Investment in the fund is reserved for warned investors under article 423-49 of the RGAMF.

Presentation of the FPCI Apax Philanthropy Fund

For an impactful investment

Seven2 offers the Apax Philanthropy Fund, a societal commitment fund. Seven2 and the companies in which it is a shareholder commits to supporting causes for which their convictions and their expertise are meaningful.

A firm conviction: the need to combine impact with performance goal

Financial return

- Draw on Seven2’s expertise to select the best assets and achieve high financial returns

- Access Seven2’s entire portfolio through systematic co-investments

Non-financial return / social impact

- Financial support for charities in the form of substantial donations maintained over the long term

- Building on this support through skills sponsorship offered by our portfolio companies as part of their ESG programmes

- Approval of the associations and projects we choose to back by a philanthropic committee made up of philanthropic experts

- Many of these associations are supported thanks to the combined efforts of investors, Seven2 and its portfolio companies

- Article 8 SFDR

A flexible and beneficial product

- An open-ended and evergreen (99-year) fund

- Offering tax benefits*

- Managed by Seven2 on a pro bono basis

* The tax advantage depends on each investor individual situation and presented arrangements are subject to subsequent modifications.

Apax Philanthropy Fund,

how does it work ?

Selecting charities to support

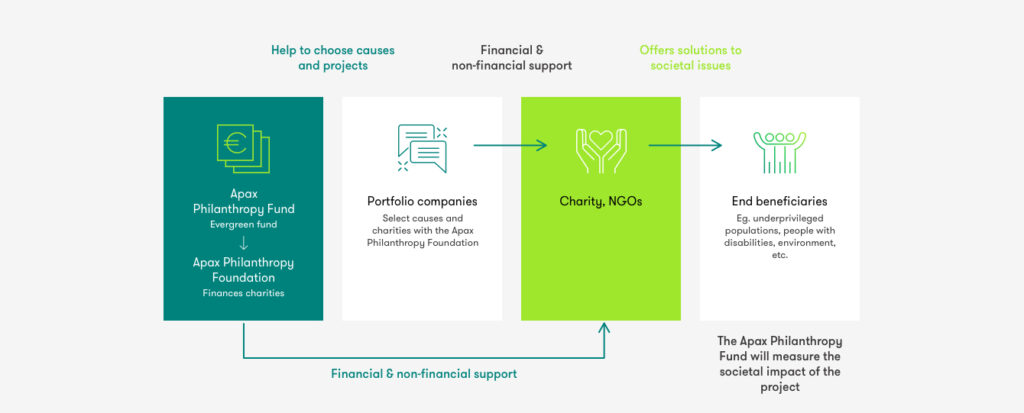

As part of their ESG programmes (Environment, Social and Governance), each of the Seven2 portfolio companies choose a cause to support via a charity or a foundation linked to its area of business and the United Nations’ 17 Sustainable Development Goals (SDGs).

Pro bono operation

The Apax Philanthropy Fund is an open-ended, evergreen fund (in other words with no pre-determined closing date) and operates on a pro bono basis, with no management commissions or carried interest for the Seven2 teams.

The Apax Philanthropy Fund co-invests directly in all of the portfolio companies selected by the Seven2 teams: French and European intermediate and small- and mid-sized companies considered to be of high quality. 20% of funds raised and one-third of its capital gains are contributed to charities in the form of donations. The remainder of the capital gains are reinvested by the Apax Philanthropy Fund to generate further capital gains and further donations.

Shills sponsoring

The Seven2 teams and those of its portfolio companies can commit to the charities supported through skills sponsoring. Following a societal project that resonates with their own business is a powerful driver for all employees, both in the companies and within Seven2.

Apax Philanthropy Fund, is the Private Equity, with its investments, making a long-term commitment to society!

to the activities of Seven2 portfolio companies

and supported by them

Focus on the Apax Philanthropy Foundation

To collect and distribute donations to charities, Seven2 has created a foundation, the Apax Philanthropy Foundation, under the aegis of Fondation de France. The Apax Philanthropy Foundation receives 20% of the subscription amounts and one-third of the capital gains generated by the Apax Philanthropy Fund.

The structure of the Foundation enables it to collect French and international donations but also to support charities acting in favour of very diverse causes, always with a link to the UN’s SDGs and the business sectors of the Seven2 portfolio companies.

Governance of the Apax Philanthropy Foundation is assigned to a committee of directors, half of whom are Seven2 members and the other half independent directors.

Risks

An investment in the fund involves risk as detailed in its prospectus, notably:

Risks linked to the underlying company

The investor bears company risk, linked to the unlisted companies held by the fund. In essence, SMEs are generally more risky than bigger companies. Furthermore, the valuation of unlisted securities held by the fund is carried out directly by the management company based on fair market value and not directly by an organised market.

Risk of capital loss

The risk of capital loss is notably linked to investments in unlisted securities.

Since the fund has no capital guarantee, part or all of the invested capital may not be recovered.

Liquidity risk

The fund invests mainly in unlisted company securities. These securities are not liquid and there is no secondary market facilitating transactions. Since the underlying assets of the fund are primarily made up of non-liquid assets, the same may be true for units in the fund despite the holding of liquid assets.

Valuation risk

It may be difficult to find appropriate price references for unlisted investments. This difficulty may have an impact on the valuation of the fund investment portfolio.

Performance risk

The investment objectives express an anticipated result, but there is no guarantee that such a result will be obtained. Based on market conditions and the macroeconomic environment, the investment objectives may become harder to achieve.

Please refer to the FPCI Apax Philanthropy Fund reglementation before making any final investment decision and in order to have detailed access to the fund’s risk factors.