As each portfolio company is unique, we collaborate hand in hand with each company to define the most relevant and value-added sustainability approach.

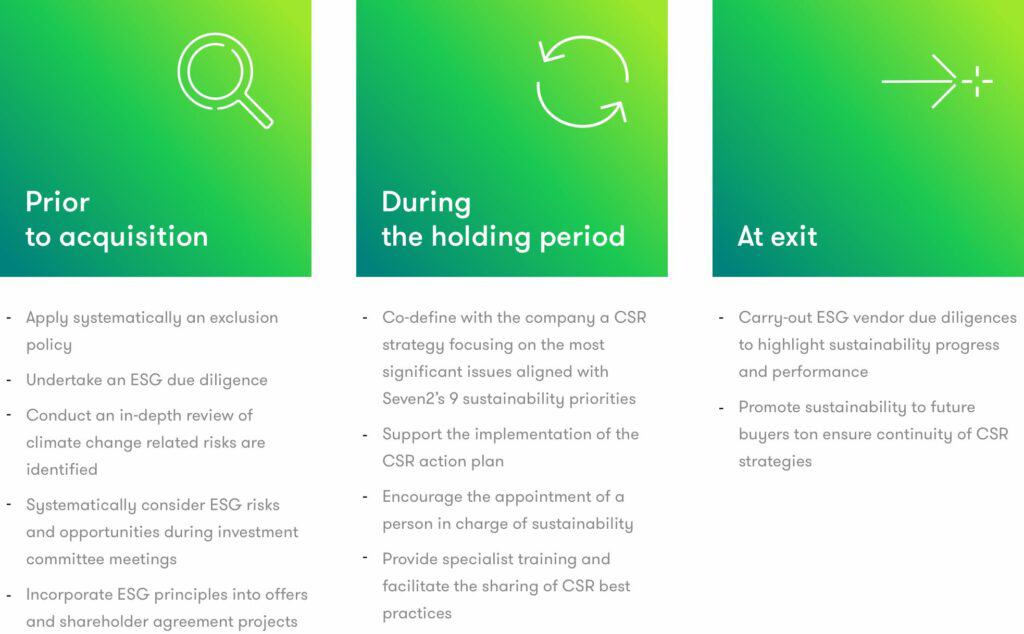

Prior to an acquisition, Seven2:

- Systematically applies an exclusion policy aligned with its values and sustainability strategy

- Undertakes an ESG due diligence, whether internal or external, with investment teams to identify potential sustainability risks and opportunities

- Conducts a thorough examination of climate change-related risks (e.g., physical and/or transition risks)

- Systematically integrates sustainability-related risks and opportunities in the Investment Committee meetings

- Verifies the possible existence of ESG controversies, considering risks related to climate change, biodiversity, as well as other social and environmental issues

- Incorporates ESG principles into offers and shareholder agreement projects

During the holding period, Seven2 supports portfolio companies in various manners, including:

- Co-defining with the company a CSR strategy focused on the most significant issues for the company and aligned with Seven2’s 9 sustainability priorities

- Assisting the portfolio company in implementing an operational action plan for this CSR strategy

- Encouraging the appointment of a person in charge of sustainability within the portfolio company reporting to senior management

- Providing specialized training on sustainability topics such as climate change, regulatory changes, social issues, etc.

- Facilitating the sharing of best practices, creating interactions, and establishing links between portfolio companies through the CSR community led by Seven2’s sustainability team

At exit:

When divesting from a portfolio company, Seven2 carries out a sustainability vendor due-diligence report to highlight its sustainability performance. This is an integral part of the overall valuation of the business.