Because all our portfolio companies are unique, we collaborate closely with each one to define the most fitting sustainability approach.

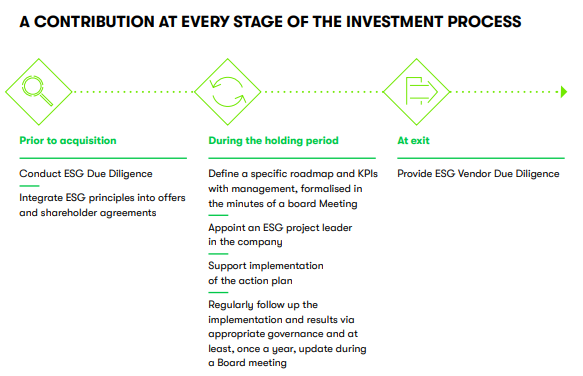

Before an acquisition

Sustainability discussions begin during the acquisition period with a sustainability due-diligence. This helps us identify risks and opportunities while also outlining the sustainability approach for the holding period.

During the detention period

After the acquisition, we carry out an in-depth review to assess the main sustainability issues and shape the sustainability strategy. At this stage, the goal is to limit any negative sustainability impacts, but more importantly to create positive value for society and the planet.

A 3-year action plan is then defined, focusing on the most relevant initiatives supported by KPIs to help monitor progress overtime. The approach is presented and validated by the Board.

Our LPs are updated twice annually on the sustainability performance of all the companies within the portfolio. And a sustainability review is organized with the Board every year to present progress and outline future actions.

At the output

At the exit of a portfolio company, we carry out a due-diligence audit to highlight the sustainability results of the company. This is an integral part of the overall valuation of the business.